I have often thought that St. Lucie County is one of the best places in the state to be a Ford dealer. Although the per capita income is less than adjoining Indian River and Martin counties, the Ford brand reflects our typical buyers—hard working, middle class men and women looking for great value in a vehicle.

St. Lucie County historically is known for its agriculture and manufacturing businesses, and now with stable construction and tourist industries, we have seen our sales and service numbers surge in the past five years.

Our neighboring counties may have more enclaves of multimillion dollar homes, but St. Lucie has a large inventory of affordable housing which is another attraction for middle class residents.

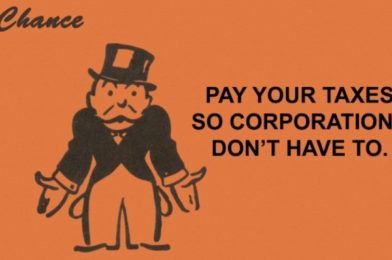

So from a business standpoint, I have taken a hard look at the GOP tax “reform” proposal and I don’t like what I see. Although the planned tax cuts would be favorable for large volume car dealers like Sunrise Ford, I am more concerned about the affect they would have on our customers.

Tax cuts for middle class families will be minimal and, in some cases, those families will see their taxes increase. The bill could eliminate state and local tax deductions. If you have a son or daughter going to college, you get an even bigger hit. There would be no more tax deductions for interest charged on student loans. Graduate students, who often get waivers on tuition and are paid stipends in exchange for their research and assistance in graduate programs, will now be taxed on both.

Compare that with those making $1 million or more, which is not your typical mom and pop store, their tax rate would drop from 39.6 percent to as low as 20 percent, depending on which version of the tax bill is finally passed. Repealing the estate tax and maintaining other loopholes for the rich make the GOP tax plan even more lopsided. And the plan is expected to drive up the national debt an additional $1.5 trillion. Republican leaders are already warning the increased debt may mean additional cuts to Social Security and Medicare.

So it is not difficult to see who are the winners and who are the losers when the bill is passed. Multimillionaires and large corporations will get the big breaks, while middle income families will not. Retirees who rely on their monthly social security checks and Medicare plans will probably have to tighten their belts even more.

Those wanting to better themselves with higher education will suffer, even though we are pushing for more educational opportunities so we can remain competitive in this highly technical world.

But what about the argument that those significant tax cuts for wealthy corporations will cause them to invest more and hire more employees? As a business owner with more than 90 employees I can assure you that will not be the case.

The only thing that stimulates the economy is demand. I can get all of the tax breaks in the world, but if I don’t have a strong customer base, there will be no need for additional employees. Sunrise Ford needs those plumbers, painters, school teachers, firefighters, grove workers, government employees, and nurses to buy our cars and trucks. Construction and landscape companies, businesses that sell fire equipment and building materials, we need those strong middle class professions and businesses to survive. Those retirees who come to St. Lucie County for the weather or the New York Mets or most importantly, affordable housing, we need them too.

For 85 years, Sunrise Ford has thrived in St. Lucie County, thanks to its stable middle class population. Although we all struggled through the recession, with record numbers of foreclosures and bankruptcies, most of us have come back strong. So right now, the last thing we need is a tax plan that will hurt our middle class and threaten our Social Security and Medicare programs.

However, it looks like some form of the tax “reform” plan will be passed by year end. I can only hope that down the road politicians will come to their senses and realize that they ,too, need that strong middle class block of voters to stay in office, and reverse this detrimental tax plan.